Real Estate Tax Pros

Helping Those Working In and On Real Estate

Blog

-

Business Deductions - Seven Tax-Cut Tricks There’s still time to minimize your most significant expenses – taxes – for this year and those that follow!

Business Deductions - Seven Tax-Cut Tricks There’s still time to minimize your most significant expenses – taxes – for this year and those that follow! -

Two Wealth-Building Tax-Cut Strategies for Kids and Grandkids One of the easiest ways to create generational wealth and avoid taxation is to invest in a child’s education and future. Here's why and how you can do it!

Two Wealth-Building Tax-Cut Strategies for Kids and Grandkids One of the easiest ways to create generational wealth and avoid taxation is to invest in a child’s education and future. Here's why and how you can do it! -

WV’s New Property Tax Credit/Rebate Do NOT Pay the Second Half of Your 2023 West Virginia Personal Property Tax Bill Until Early 2024

WV’s New Property Tax Credit/Rebate Do NOT Pay the Second Half of Your 2023 West Virginia Personal Property Tax Bill Until Early 2024 -

Retirement Taxation Deferred vs. Non-Deferred vs. the ROTH A review of the tax implications of three popular retirement-saving options.

Retirement Taxation Deferred vs. Non-Deferred vs. the ROTH A review of the tax implications of three popular retirement-saving options. -

April 15th: Media Hype & The Audit Myth Learn how the media has utilized the tax "deadline" as an eyeball-catching, fear-arousing, space & time-filling, ad-selling tool.

April 15th: Media Hype & The Audit Myth Learn how the media has utilized the tax "deadline" as an eyeball-catching, fear-arousing, space & time-filling, ad-selling tool. -

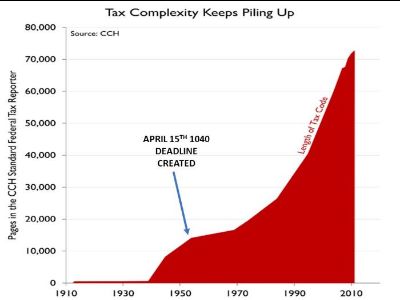

Why is April 15th the Extension-Filing Deadline? A brief history of Form 1040’s due date

Why is April 15th the Extension-Filing Deadline? A brief history of Form 1040’s due date -

2022 Notable Individual Tax Changes Our job is to inform you of tax changes that may impact your financial picture. To this end, We’ve compiled a brief list of changes that may affect your 2022 taxes.

2022 Notable Individual Tax Changes Our job is to inform you of tax changes that may impact your financial picture. To this end, We’ve compiled a brief list of changes that may affect your 2022 taxes. -

Coping with April 15th Stress Disorder In this article, I will discuss the symptoms and prevalence of April 15th Stress Disorder and how it endangers the tax profession when expertise is most needed.

Coping with April 15th Stress Disorder In this article, I will discuss the symptoms and prevalence of April 15th Stress Disorder and how it endangers the tax profession when expertise is most needed. -

The Earned Income Tax Credit - History & 2021 Changes This article will focus on changes to the Earned Income Tax Credit.

The Earned Income Tax Credit - History & 2021 Changes This article will focus on changes to the Earned Income Tax Credit. -

The American Rescue Plan & The 2021 Child Tax Credit Mess In this article I’ll highlight some changes sure to impact most 2021 returns. Then, I’ll dig into the details of the 2021 Child Tax Credit.

The American Rescue Plan & The 2021 Child Tax Credit Mess In this article I’ll highlight some changes sure to impact most 2021 returns. Then, I’ll dig into the details of the 2021 Child Tax Credit. -

More 2020 Tax Changes & Year-End Tips The year is coming to a close, and, for many, saying goodbye to 2020 couldn’t happen fast enough.

More 2020 Tax Changes & Year-End Tips The year is coming to a close, and, for many, saying goodbye to 2020 couldn’t happen fast enough. -

Deducting Business Attire, Real Estate Agents & Small Business Owners In this article, we'll discuss work clothing that is (and is not) deductible.

Deducting Business Attire, Real Estate Agents & Small Business Owners In this article, we'll discuss work clothing that is (and is not) deductible. -

Tips For Deducting Cell Phone Use by Real Estate Agents & Small Business Owners This article will discuss how the deduction for verbal business communication has changed with the growing prevalence of cellular phones.

Tips For Deducting Cell Phone Use by Real Estate Agents & Small Business Owners This article will discuss how the deduction for verbal business communication has changed with the growing prevalence of cellular phones. -

Other Deductible Expenses on Schedule C Real Estate Agents & Small Business Owners Here is a non-inclusive list of everyday real estate expenses that get deducted as Other Expenses (and some outlays that are not deductible at all).

Other Deductible Expenses on Schedule C Real Estate Agents & Small Business Owners Here is a non-inclusive list of everyday real estate expenses that get deducted as Other Expenses (and some outlays that are not deductible at all). -

Deducting Wages, Real Estate Agents & Schedule C Understanding wages deducted by self-employed Real Estate Agents.

Deducting Wages, Real Estate Agents & Schedule C Understanding wages deducted by self-employed Real Estate Agents. -

Deducting Utilities, Real Estate Agents & Schedule C Deducting utilities on your Schedule C is relatively straightforward but determinig where they get deducted depends on the location of the utilities.

Deducting Utilities, Real Estate Agents & Schedule C Deducting utilities on your Schedule C is relatively straightforward but determinig where they get deducted depends on the location of the utilities. -

Deducting Business Meals, Real Estate Agents & Sole Proprietors In this article, we’ll discuss what business meals are deductible and, in the process, address some of the misconceptions surrounding deducible business meals.

Deducting Business Meals, Real Estate Agents & Sole Proprietors In this article, we’ll discuss what business meals are deductible and, in the process, address some of the misconceptions surrounding deducible business meals. -

Deducting Domestic Travel Part Four: Substantiating Business Travel Deduction In this, our final travel article, I'll provide tips on substantiating your travel deduction.

Deducting Domestic Travel Part Four: Substantiating Business Travel Deduction In this, our final travel article, I'll provide tips on substantiating your travel deduction. -

Deducting Domestic Travel Part Three: Deductible Expenses In this article, we'll discuss when and what travel costs are deductible.

Deducting Domestic Travel Part Three: Deductible Expenses In this article, we'll discuss when and what travel costs are deductible. -

Deducting Domestic Travel, Part Two: Maximizing Business Days In this article, we will dig a little deeper into the pivotal and most challenging test to pass, number four - Primary Business Purpose.

Deducting Domestic Travel, Part Two: Maximizing Business Days In this article, we will dig a little deeper into the pivotal and most challenging test to pass, number four - Primary Business Purpose. -

Giving to Caesar: Taxing Ministers My goal in this article is to help ministers prepare for next tax season and to enlighten church leaders about how the IRS taxes their minister’s compensation.

Giving to Caesar: Taxing Ministers My goal in this article is to help ministers prepare for next tax season and to enlighten church leaders about how the IRS taxes their minister’s compensation. -

Rental Properties & the Qualified Business Income Deduction: Tread Lightly Whether rental properties rise to the level of a trade or business for purposes of the QBI deduction is a source of confusion and consternation for tax professionals and landlords alike.

Rental Properties & the Qualified Business Income Deduction: Tread Lightly Whether rental properties rise to the level of a trade or business for purposes of the QBI deduction is a source of confusion and consternation for tax professionals and landlords alike. -

Deducting Travel Expenses as a Real Estate Agent, Part One: The Four Tests This article explains four criteria required for trips to meet the IRS definition of deductible business travel.

Deducting Travel Expenses as a Real Estate Agent, Part One: The Four Tests This article explains four criteria required for trips to meet the IRS definition of deductible business travel. -

FREE Tax Organizer for Real Estate Agents Signup & Download Your FREE Real Estate Agent Tax Organizer (The Best Tax Organizer Out There)

FREE Tax Organizer for Real Estate Agents Signup & Download Your FREE Real Estate Agent Tax Organizer (The Best Tax Organizer Out There) -

Last Minute RETROACTIVE 2018 & 2019 Tax Changes for Individuals (January 2020) We created this article to summarize a few changes in the Further Consolidated Appropriations Act that may impact you personally.

Last Minute RETROACTIVE 2018 & 2019 Tax Changes for Individuals (January 2020) We created this article to summarize a few changes in the Further Consolidated Appropriations Act that may impact you personally. -

2019 Year-End Business Tips & Reminders The new year is almost here, get your ducks in a row now with our VERY THOROUGH Year-End Business Newsletter.

2019 Year-End Business Tips & Reminders The new year is almost here, get your ducks in a row now with our VERY THOROUGH Year-End Business Newsletter. -

Qualified Residence Indebtedness Exclusion Retroactively Extended for 2017, 2018, and 2019 This article will discuss the challenge faced by those who owe more debt on a home than the home is worth and an overview of remedies to avoid taxes on that debt.

Qualified Residence Indebtedness Exclusion Retroactively Extended for 2017, 2018, and 2019 This article will discuss the challenge faced by those who owe more debt on a home than the home is worth and an overview of remedies to avoid taxes on that debt. -

Real Estate Agents, Deducting Taxes and Licenses on Schedule C This article will help you accurately report tax and license costs on Line 23 (and make sure you do not expense costs that are illegal to deduct).

Real Estate Agents, Deducting Taxes and Licenses on Schedule C This article will help you accurately report tax and license costs on Line 23 (and make sure you do not expense costs that are illegal to deduct). -

Real Estate Agents, Deducting Supplies on Schedule C Items that are regularly consumed by your business are supplies and are generally deductible in the year of purchase.

Real Estate Agents, Deducting Supplies on Schedule C Items that are regularly consumed by your business are supplies and are generally deductible in the year of purchase. -

I’m a Real Estate Agent, Do I Qualify for the 20% Income Deduction? The vast majority of self-employed real estate agents will qualify for the 20% Income Deduction! Here's how.

I’m a Real Estate Agent, Do I Qualify for the 20% Income Deduction? The vast majority of self-employed real estate agents will qualify for the 20% Income Deduction! Here's how. -

Real Estate Agents, Deducting Repairs and Maintenance With a few exceptions, items deducted as repairs and maintenance are pretty straight-forward.

Real Estate Agents, Deducting Repairs and Maintenance With a few exceptions, items deducted as repairs and maintenance are pretty straight-forward. -

Real Estate Agents, Deducting Rent & Leases on Schedule C This article will explain how and where is rent is deducted by a sole proprietor Real Estate Agent.

Real Estate Agents, Deducting Rent & Leases on Schedule C This article will explain how and where is rent is deducted by a sole proprietor Real Estate Agent. -

Real Estate Agents, Schedule C, Line 19 - Pension & Profit-Sharing Plans Deduct employer contributions and administrative costs of employee retirement plans on Line 19, Pension and Profit-Sharing Plans.

Real Estate Agents, Schedule C, Line 19 - Pension & Profit-Sharing Plans Deduct employer contributions and administrative costs of employee retirement plans on Line 19, Pension and Profit-Sharing Plans. -

Real Estate Agents, Deducting Office Expenses Clarifying what is and is not deductible on Line 18 of Schedule C is the topic of this article.

Real Estate Agents, Deducting Office Expenses Clarifying what is and is not deductible on Line 18 of Schedule C is the topic of this article. -

Real Estate Agents, Deducting Legal and Professional Services This article will help you understand what is and is not deductible on Line 17, Legal and Professional Services.

Real Estate Agents, Deducting Legal and Professional Services This article will help you understand what is and is not deductible on Line 17, Legal and Professional Services. -

Real Estate Agents, Deducting Interest Expense Part Three: Deducting Loan Interest Once you know business loan interest is deductible, the next question is Where and when do I take the deduction. This article answers this question.

Real Estate Agents, Deducting Interest Expense Part Three: Deducting Loan Interest Once you know business loan interest is deductible, the next question is Where and when do I take the deduction. This article answers this question. -

Real Estate Agents, Deducting Interest Expense Part Two: Business Use of Loan Proceeds This article will help agents understand the business-purpose requirement while pointing out a common pitfall that threatens their interest deduction.

Real Estate Agents, Deducting Interest Expense Part Two: Business Use of Loan Proceeds This article will help agents understand the business-purpose requirement while pointing out a common pitfall that threatens their interest deduction. -

Real Estate Agents, Deducting Interest Expense Part One: Meeting the Loan Definition When is the interest paid on loans deductible on Line 16 of Schedule C, Profit and Loss from Business?

Real Estate Agents, Deducting Interest Expense Part One: Meeting the Loan Definition When is the interest paid on loans deductible on Line 16 of Schedule C, Profit and Loss from Business? -

Real Estate Agents, Deducting Insurance (other than Health) This article will discuss premiums deducted on Line 15 of Schedule C, Insurance (other than health).

Real Estate Agents, Deducting Insurance (other than Health) This article will discuss premiums deducted on Line 15 of Schedule C, Insurance (other than health). -

Real Estate Agents, Deducting Employee Benefit Programs Some things to consider when hiring as a real estate agent.

Real Estate Agents, Deducting Employee Benefit Programs Some things to consider when hiring as a real estate agent. -

Real Estate Agents, Bonus Depreciation & Section 179 Expense This article will discuss Bonus Depreciation and Section 179 Expense as it applies to personal property purchases of Real Estate Agents and small business owners.

Real Estate Agents, Bonus Depreciation & Section 179 Expense This article will discuss Bonus Depreciation and Section 179 Expense as it applies to personal property purchases of Real Estate Agents and small business owners. -

Real Estate Agents, Depreciation Expense This article will discuss the basics of depreciation as it applies to other items commonly depreciated by real estate agents.

Real Estate Agents, Depreciation Expense This article will discuss the basics of depreciation as it applies to other items commonly depreciated by real estate agents. -

Real Estate Agents, Commissions & Fees, Contract Labor & Depletion In this article, we will continue our line-by-line Schedule C discussion, with three more deductions: Commissions and Fees, Contract Labor, and Depletion

Real Estate Agents, Commissions & Fees, Contract Labor & Depletion In this article, we will continue our line-by-line Schedule C discussion, with three more deductions: Commissions and Fees, Contract Labor, and Depletion -

Real Estate Agents, Home Office Deduction Actual Cost Method Part Two: Home Office Depreciation This article wraps up the Actual Cost Method with the basics of home office depreciation.

Real Estate Agents, Home Office Deduction Actual Cost Method Part Two: Home Office Depreciation This article wraps up the Actual Cost Method with the basics of home office depreciation. -

Real Estate Agents, Home Office Deduction Actual Cost Method Part One: Direct and Indirect Costs This article will introduce the Actual Cost Method and discuss direct and indirect home office expenses.

Real Estate Agents, Home Office Deduction Actual Cost Method Part One: Direct and Indirect Costs This article will introduce the Actual Cost Method and discuss direct and indirect home office expenses. -

Real Estate Agents, Home Office Deduction Methods & the Simplified Method This article will introduce the Simplified Method and the Actual Cost Method, share the basic rules that govern the home office deduction, and explain the Simplified Method.

Real Estate Agents, Home Office Deduction Methods & the Simplified Method This article will introduce the Simplified Method and the Actual Cost Method, share the basic rules that govern the home office deduction, and explain the Simplified Method. -

Real Estate Agents, Home Office Deduction Requirements This article will discuss the IRS requirements for having a deductible home office.

Real Estate Agents, Home Office Deduction Requirements This article will discuss the IRS requirements for having a deductible home office. -

Real Estate Agents, Auto Expenses: Deducting a Leased Vehicle The goal of this article is to help you to understand the deductibility of leasing a vehicle.

Real Estate Agents, Auto Expenses: Deducting a Leased Vehicle The goal of this article is to help you to understand the deductibility of leasing a vehicle. -

Real Estate Agents, Auto Expenses: Bonus Depreciation & Section 179 Expense This article expands on our article covering auto depreciation by sharing the basics of Bonus Depreciation and the 179 Expense as they pertain to vehicles.

Real Estate Agents, Auto Expenses: Bonus Depreciation & Section 179 Expense This article expands on our article covering auto depreciation by sharing the basics of Bonus Depreciation and the 179 Expense as they pertain to vehicles. -

Real Estate Agents, Deducting Auto Expenses: Depreciation Basics In this article we'll cover the basics of auto depreciation.

Real Estate Agents, Deducting Auto Expenses: Depreciation Basics In this article we'll cover the basics of auto depreciation. -

Real Estate Agents, Deducting Auto Expenses: The Actual Cost Method Thinking of using the Actual Cost method of deducting auto use? Here are the pro's and con's of this method.

Real Estate Agents, Deducting Auto Expenses: The Actual Cost Method Thinking of using the Actual Cost method of deducting auto use? Here are the pro's and con's of this method. -

Real Estate Agents, Auto Deduction Options: Standard Mileage Rate Regardless, of how you use your driving-time, life behind the wheel offers one key benefit (at least we tax-pros think so) – it’s all deductible!

Real Estate Agents, Auto Deduction Options: Standard Mileage Rate Regardless, of how you use your driving-time, life behind the wheel offers one key benefit (at least we tax-pros think so) – it’s all deductible! -

Real Estate Agents, Deducting Promotional Donations For community-minded real estate agents, the question isn’t whether to support local charities; it’s how to maximize their value!

Real Estate Agents, Deducting Promotional Donations For community-minded real estate agents, the question isn’t whether to support local charities; it’s how to maximize their value! -

Real Estate Agents, Deducting Promotional Items & Gifts There are tax consequences to gifts and giveaways, and many agents are surprised to learn just how stringent the IRS rules are.

Real Estate Agents, Deducting Promotional Items & Gifts There are tax consequences to gifts and giveaways, and many agents are surprised to learn just how stringent the IRS rules are. -

Real Estate Agents, Common Advertising Deductions Learn about some of the Ordinary and Necessary Advertising expenses that are deductible for Real Estate Agents.

Real Estate Agents, Common Advertising Deductions Learn about some of the Ordinary and Necessary Advertising expenses that are deductible for Real Estate Agents. -

Real Estate Agents & Contractors, Writing Off Personal Items Used in Business Using personal property in a business is called converting personal items to business use and is deductible if you follow the rules!

Real Estate Agents & Contractors, Writing Off Personal Items Used in Business Using personal property in a business is called converting personal items to business use and is deductible if you follow the rules! -

Real Estate Agents, Overview of Income and Deductions Realtors, listen up! Every dollar you deduct as a business expense saves forty cents in tax, and puts it into your pocket!

Real Estate Agents, Overview of Income and Deductions Realtors, listen up! Every dollar you deduct as a business expense saves forty cents in tax, and puts it into your pocket! -

Real Estate Agents, Are License Training & Exam Fees Deductible? In this article, we’ll why training costs are not deductible when calculating a real estate agent’s taxable income.

Real Estate Agents, Are License Training & Exam Fees Deductible? In this article, we’ll why training costs are not deductible when calculating a real estate agent’s taxable income. -

Proving your Deductions, Easy Recordkeeping for Real Estate Agents A look at the two primary reasons real estate agents lose deductions and pay more tax than they should.

Proving your Deductions, Easy Recordkeeping for Real Estate Agents A look at the two primary reasons real estate agents lose deductions and pay more tax than they should. -

Real Estate Agents & Self-Employment Tax Real Estate Agents are self-employed – independent contractors in business for themselves, responsible for paying their own taxes.

Real Estate Agents & Self-Employment Tax Real Estate Agents are self-employed – independent contractors in business for themselves, responsible for paying their own taxes. -

Is Your Real Estate Business a Hobby? Avoiding the Hobby Tax-Trap Are you a real estate agent with a business or a hobby? You should nail that down.

Is Your Real Estate Business a Hobby? Avoiding the Hobby Tax-Trap Are you a real estate agent with a business or a hobby? You should nail that down. -

No Proof - No Deduction, An Easy Way to Track Mileage For Real Estate Agents & Small Business Owners No proof, no deduction. A three-step process for tracking mileage to substantiate your tax deductions.

No Proof - No Deduction, An Easy Way to Track Mileage For Real Estate Agents & Small Business Owners No proof, no deduction. A three-step process for tracking mileage to substantiate your tax deductions. -

Real Estate Agents: What Auto Use is Deductible? A Lot More if You Have a Home Office! The auto deduction is a real estate agent’s largest tax deduction. We show you how you can make the most of this deduction.

Real Estate Agents: What Auto Use is Deductible? A Lot More if You Have a Home Office! The auto deduction is a real estate agent’s largest tax deduction. We show you how you can make the most of this deduction. -

Real Estate Agents, the #1 key to maximizing your tax deductions is your home office Maximum tax deductions for real estate agents start with having a qualified home office. This article explains the "Why?" and "How?" of setting up a home office.

Real Estate Agents, the #1 key to maximizing your tax deductions is your home office Maximum tax deductions for real estate agents start with having a qualified home office. This article explains the "Why?" and "How?" of setting up a home office.